Industry Analysis & Industry Trends

After steep declines during the recession, the Air Purification Equipment Manufacturing industry experienced several years of uneven sales growth. In the next five years, the industry will continue to experience slow growth, however, demand growth from the industrial sector will somewhat wane. Business and consumer demand growth, however, will accelerate slightly as these markets shake off the lingering effects of the recession.

Industry Report - Industry Locations Chapter

Business locations in the Air Purification Equipment Manufacturing industry are most heavily concentrated in the Southeast (26.8%), Great Lakes (22.3%) and West (14.5%). Demand is distributed based on population patterns with concentration especially high in manufacturing areas. By state, California, Illinois and Texas, three of the most populous states in the nation, have the highest numbers of establishments. The Great Lakes region has a higher share of industry establishments than its proportion of US population. This is largely due to the concentration of industrial activity in the region.

What is the Air Purification Equipment Manufacturing Industry?

This industry manufactures stationary air-purification equipment, such as industrial dust and fume collection equipment, electrostatic precipitation equipment, warm-air furnace filters, air washers and other dust collection equipment.

Industry Products

High Efficiency Particulate Air (HEPA) filter

Industry Activities

Manufacturing High Efficiency Particulate Air (HEPA) filters• Strongest air purifier usage is during the 'closed window season' and 'allergy season'. Allergy season varies by

region.

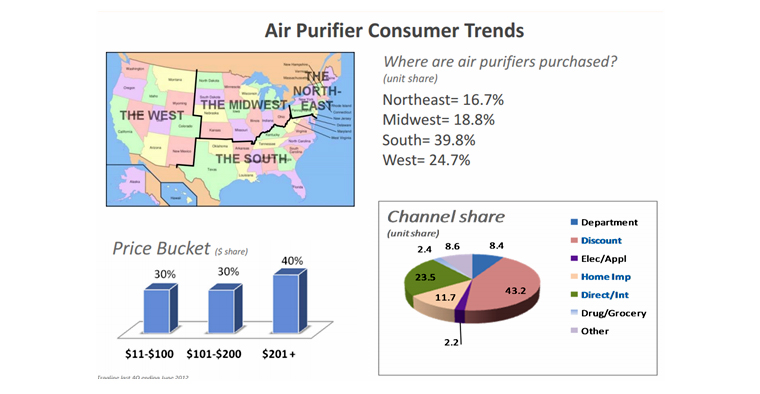

Purchasing Patterns of the US:

• Northeast 16.7%

Americans primarily use their purifiers for:

1. Reduce Allergens

61%

2. Reduce Dust

59%

3. Reduce Pet Dander

39%

4. Reduce Odors

39%

5. Reduce Asthma

25%

6. Reduce Smoke

22%

|

Purchaser: |

|

|

Male |

44% |

| Female |

56% |

Air purifiers are purchased based on need:

Medical

Market Challenge

• Declining profit margin

Market Trend

• Shifting towards vertical integration